does san francisco have a payroll tax

Article 12-A the Payroll Expense. The ordinance became effective October 1 1970.

Payroll Bookkeeper Salary In San Francisco Ca Comparably

Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to.

. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City. All 92 counties in Indiana have an individual income tax ranging from 15 in Vermillion County to 285 in Pulaski County. California State Disability Insurance Payroll Tax To contact the San Francisco Department of Revenue please call 916-845-4900.

In states with large urban areas youll often find local taxes added to your employment tax requirements. Gross Receipts Tax and Payroll Expense Tax. The City began making the transition to a Gross Receipts Tax from a Payroll.

San Francisco Business and Tax Regulations Code. Nomersbiz Prepare A Tax Return Services In Usa Business Tax Tax Services Online Taxes. For example San Francisco Denver and Newark require.

There is a San Francisco gross receipts tax that took effect in 2014 that replaces the San Francisco payroll tax. Our payroll software is QuickBooks compatible and can. The payroll tax generates approximately six percent of San Francisco yearly budget.

From 1970 until Spring 2001 San Francisco maintained an alternative- measure business tax consisting of a 15 payroll tax and a varying rate gross receipts tax. Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. No one because there isnt one.

Nonresidents who work in San Francisco. Allen County levies an income tax at 148. Businesses operating in San Francisco pay business taxes primarily based on gross receipts.

Does san francisco have a payroll tax Monday June 13 2022 Edit. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. San Francisco taxes businesses based on gross receipts and payroll as well as business personal property like machinery equipment or fixtures.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. This is imposed on businesses operating in. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

Lean more on how to submit these installments online to. The passage of Proposition F. The Payroll Tax is a tax on the payroll expense of persons and associations engaging in business in San Francisco.

Last year the citys haul from the tax amounted to around 400 million. Businesses that pay the Administrative Office Tax will pay an additional 04 to 24 on their payroll expense in San Francisco in lieu of the additional gross receipts tax. Businesses operating in San Francisco pay business taxes primarily based on gross receipts.

From imposing a single payroll tax to adding a gross receipts tax on. Proposition F fully repeals the Payroll Expense. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

Proposition F fully repeals the Payroll Expense. The City began making the transition to a Gross Receipts Tax from a Payroll. Every SPUR February.

Some businesses may be.

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

San Francisco Isn T Dying Despite Tech Departures

San Francisco S New Local Tax Effective In 2022

Maria Jocelyn Co Owner Nomersbiz Accounting Payroll Tax Services Linkedin

Payroll Services Tax Hr San Francisco Ca Primepay

Tax Solutions 4751 Mission St San Francisco Ca Yelp

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

Mayor Ed Lee Payroll Tax Taxes Job Creation In San Francisco Techcrunch

Local Income Taxes In 2019 Local Income Tax City County Level

Trump S Payroll Tax Cut Would Terminate Social Security Critics Say

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

San Francisco S Confusing Business Taxes Could Get Another Overhaul San Francisco Business Times

Prominent Start Ups In San Francisco Resist A Payroll Tax The New York Times

S F Waives Payroll Taxes Other Fees For 300 Nightlife Businesses San Francisco Business Times

San Francisco Gross Receipts Tax

Sf Voters Approve First In The Nation Ceo Tax That Targets Inequality Calmatters

Gross Receipts Tax And Payroll Expense Tax Sfgov

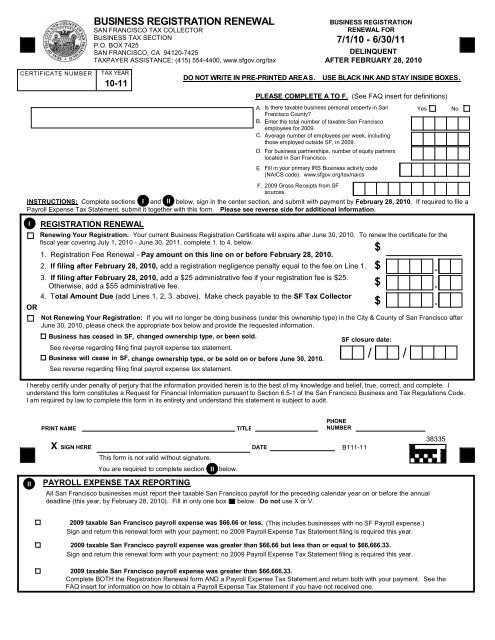

2009 Lg Payroll Tax Statement And 2010 2011 Registration Form